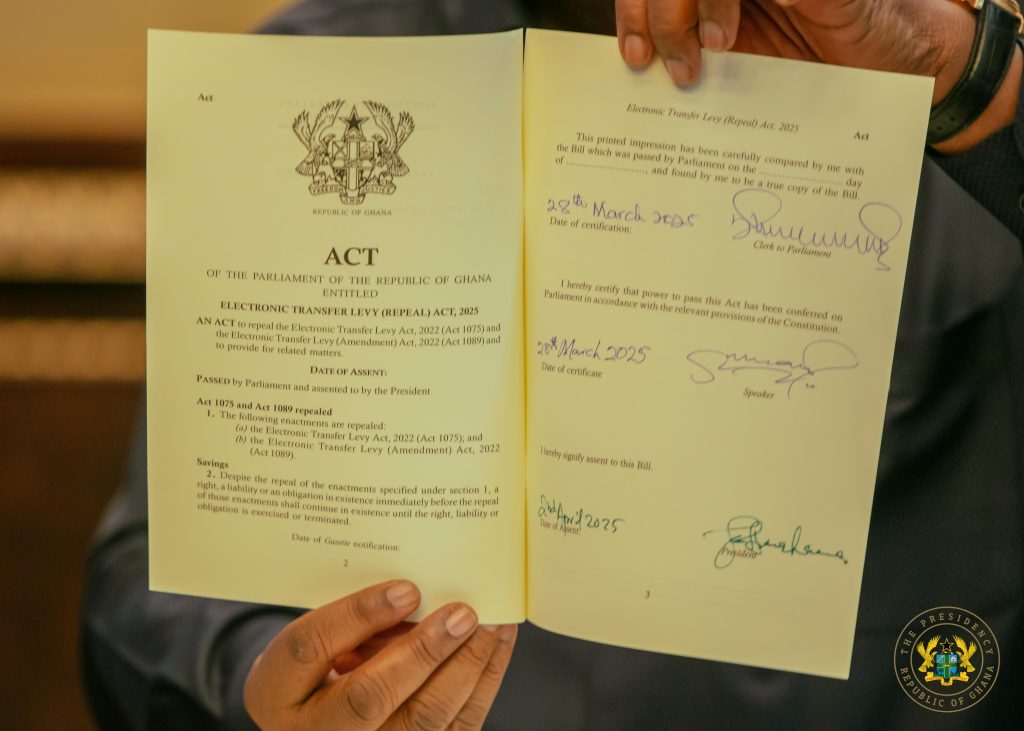

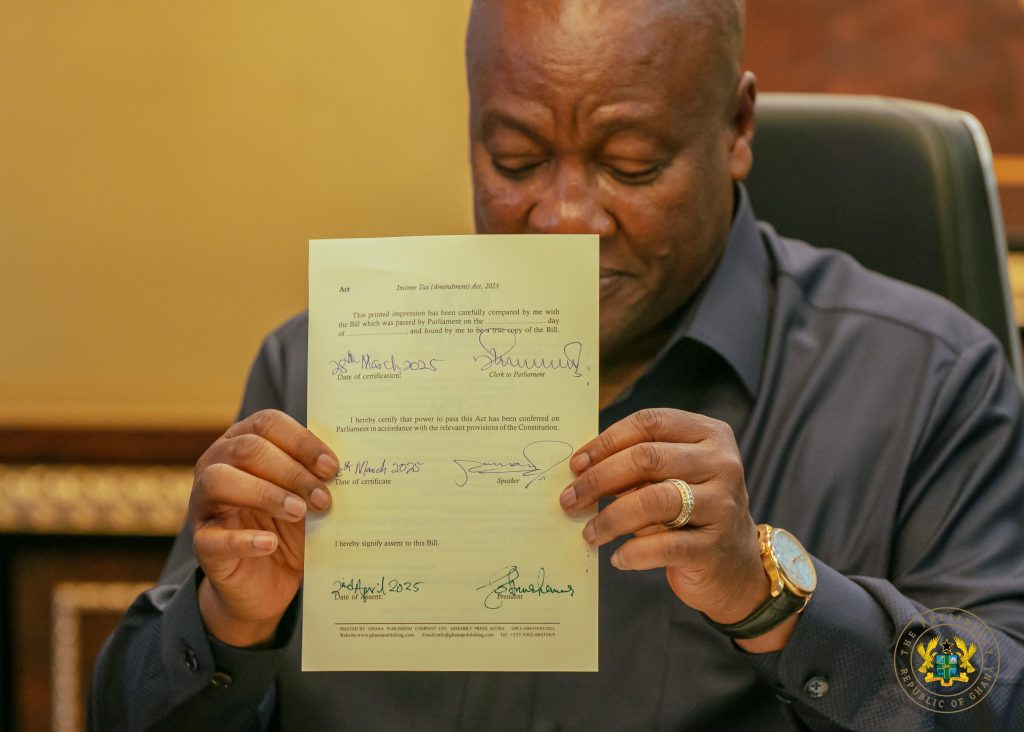

John Dramani Mahama has officially assented to a series of legislative bills abolishing several taxes.

The reforms include the repeal of the Electronic Transfer Levy (E-Levy), Betting Tax, and Emissions Levy, aligning with the National Democratic Congress’s (NDC) campaign promises.

The E-Levy, introduced in 2022, imposed a 1% charge on electronic transactions, sparking widespread public resistance due to its impact on disposable incomes.

The Betting Tax, which levied a 10% charge on gross winnings from gambling activities, faced criticism from stakeholders in the gaming industry.

The Emissions Levy also faced opposition due to its operational costs for businesses

On March 13, 2025, Finance Minister Dr. Cassiel Ato Forson presented eight bills to Parliament, including the Electronic Transfer Levy (Repeal) Bill, 2025; Emissions Levy (Repeal) Bill, 2025; and Income Tax (Amendment) Bill, 2025. These bills were fast-tracked under a Certificate of Urgency and passed on March 26, 2025.

President Mahama’s approval of these bills fulfills his campaign pledge to abolish these taxes within his first 120 days in office, a key part of the NDC’s “120-day Social Contract”.

The following bills were signed into law by President Mahama:

- Electronic Transfer Levy (Repeal) Bill, 2025: Abolishes the E-Levy.

- Income Tax (Amendment) Bill, 2025: Abolishes the Betting Tax and the 1.5% withholding tax on unprocessed gold.

- Emissions Levy (Repeal) Bill, 2025: Scraps the carbon emissions levy.

- Earmarked Funds Capping and Realignment (Amendment) Bill, 2025: Uncaps key statutory funds.

- Public Financial Management Amendment Bill

- Public Procurement Amendment Bill

- Value Added Tax Amendment Bill (VAT on Insurance)

- Petroleum Revenue Amendment Bill, 2025

These reforms are expected to stimulate economic growth, support businesses, and provide relief to individuals

Source: www.kumasimail.com/Kwadwo Owusu