The Bank of Ghana says the country’s economy has made a strong turnaround, with key indicators showing significant improvement compared to a year ago.

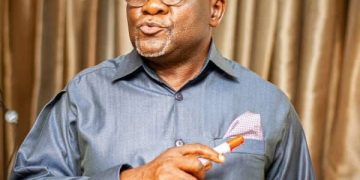

Speaking at the opening of the Monetary Policy Committee’s (MPC) 127th meetings, Governor Dr. Johnson Pandit Asiama said Ghana is entering a phase of renewed stability supported by declining inflation, a stable currency, stronger reserves, and broad-based economic growth.

According to the Governor, headline inflation has fallen to 8.0 percent, returning to the central bank’s target band earlier than anticipated. Core inflation has also eased to between 5 and 7 percent, with inflation expectations well anchored.

On the currency front, Dr. Asiama noted that the cedi has remained resilient throughout 2025, supported by improved market confidence, reforms to foreign exchange operations, and strong trade inflows.

He added that Ghana’s gross international reserves have climbed to US$11.41 billion, providing 4.8 months of import cover, and are expected to reach five months by the end of the year.

Economic activity is also picking up pace. The first half of 2025 saw GDP growth of 6.3 percent, driven largely by strong performance in the services and agriculture sectors.

Non-oil GDP surged to 7.8 percent, while the Bank’s Composite Index of Economic Activity rose by about 9 percent, reflecting improved business and consumer sentiment.

“These gains confirm that the negative output gap is narrowing, and the economy is gradually shifting from recovery to expansion,” Dr. Asiama said.

He attributed the progress to disciplined fiscal management, a cautious monetary policy stance, and structural reforms particularly in the FX market and reserve management.

The 2026 Budget, he added, reinforces this discipline and places job creation at the centre of the country’s next growth phase.

Looking ahead, the Bank of Ghana expects the favourable growth trend to continue through 2026, supported by a strong harvest season, improved food supply, better FX liquidity, and an easing credit environment.

Inflation is projected to settle between 4 and 6 percent by year-end and remain stable around the target range in 2026.

However, Dr. Asiama warned that global uncertainties such as commodity price volatility and geopolitical tensions still pose risks.

Domestic pressures including taxes, utility costs, and credit conditions also continue to affect business operations.

The Governor highlighted three key issues on the agenda for the MPC’s deliberations including managing the pace of disinflation and adjusting real interest rates without undermining policy credibility, strengthening FX market reforms and diversifying reserve assets, especially to reduce overreliance on gold holdings and ensuring financial sector stability, including addressing asset quality concerns and supporting effective credit transmission to the real economy.

Dr. Asiama said maintaining stability while supporting Ghana’s emerging growth momentum remains the central bank’s priority. “Our decisions today must reinforce confidence, signal predictability, and keep the economy on its path toward higher, job-rich growth,” he concluded.

Source: www.kumasimail.com