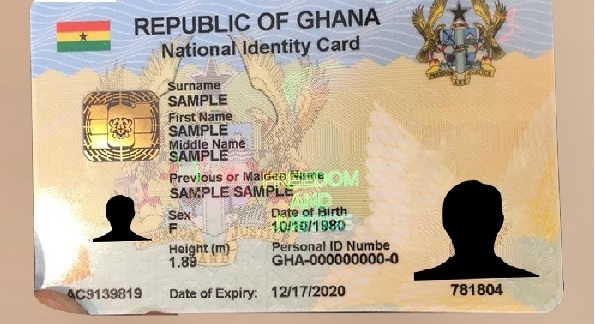

In a sweeping update to the nation’s financial regulations, the Bank of Ghana has issued a revised Supervisory Guidance Note mandating the Ghana Card as the primary and, in most cases, sole identification document for all customer transactions within accountable institutions.

The 2025 directive, which came into effect immediately upon its issue in October and was published on the Bank of Ghana website on January 8, 2026, supersedes the 2022 guidelines and introduces rigorous new verification procedures for both new and existing customers.

The guidance note provides clarity on Bank of Ghana Notice Number BG/GOV/SEC/2025/36, issued on November 13, 2025, and is designed to enforce strict compliance with Know Your Customer (KYC) and Customer Due Diligence (CDD) requirements.

It explicitly states that “Accountable Institutions (AIs) shall use only the Ghana Card to identify and verify all customers,” a rule that applies to Ghanaian citizens at home and abroad, permanent residents, and resident ECOWAS nationals during account opening.

For the first time, the guidelines also enforce the Ghana Card requirement for “Foreign Directors/Shareholders and Non-Residents who are signatories to accounts during onboarding.” This move significantly tightens the identification framework for all individuals linked to financial accounts in Ghana.

The document outlines distinct verification pathways for different customer categories. Notably, for digital onboarding via mobile applications and internet banking—areas deemed high-risk for money laundering and terrorist financing—identification “shall not be risk-based.” Institutions must utilise a liveness check to biometrically verify the customer in addition to collecting all necessary KYC data.

Existing customers undertaking transactions will be verified “on a risk-based approach,” with AIs required to update customer data using information from the National Identity Authority (NIA). The guidelines draw a firm line for those without the card, stating, “Where a customer has not registered for the Ghana Card, Non-Citizen Identity Card or Refugee Identity Card, the AI shall not undertake any financial transaction for or on behalf of the customer.”

Provisions are made for specific groups. Foreign non-residents in the country for less than 90 days undertaking one-off transactions, such as remittances, may use a valid international passport but must provide additional details like visa information and date of entry.

Foreign diplomats and their dependents may use diplomatic passports or cards issued by competent authorities. The guidance provides extensive technical support for institutions, detailing causes and solutions for failed biometric verifications—whether due to poor lighting, dirty camera lenses, or faint fingerprints—and establishes a clear escalation matrix for resolving “No Match” or “Failed” verification results.

In such cases, customers may be referred to the NIA, and new customers face a 90-day deferral period to update their records before an account becomes operational.

Business continuity procedures are also specified, instructing institutions to use specialised MECO devices in offline mode during system downtimes. However, for third parties and existing customers without a physical card present during such outages, “only deposits shall be performed.”

The note includes transitional provisions. It clarifies that “linking one’s Ghana Card to the bank account does not have an expiry date.”

Ghanaians abroad without access to the card may temporarily use passports, and third-party deposits into accounts of customers who have not updated their records with the Ghana Card are permitted, though “no debit withdrawal should be placed on such customer accounts.” Diplomatic Corps members are exempt and may use foreign passports, in line with existing national regulations.

This comprehensive regulatory shift underscores the government’s drive to integrate the national identification system fully into the financial ecosystem, aiming to enhance security, curb fraud, and streamline customer verification processes across the board.

Source: www.kumasimail.com