A new community-based, zero-interest microfinance initiative, the Community Enterprise and Livelihood Fund (CELF), has been launched to support market women, traders, artisans and youth entrepreneurs, with an initial focus on the Ashanti Region.

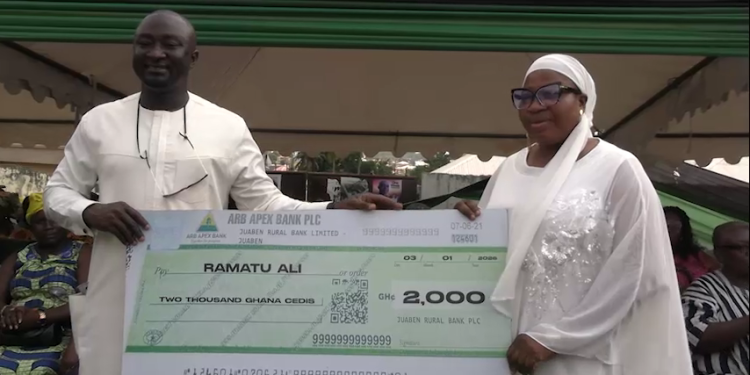

The fund, delivered by Masawud Mubarick, Deputy Director-General of the Ghana Maritime Authority (GMA) is designed to expand access to capital for small-scale business operators who have long been excluded from formal financial systems and often forced to rely on high-interest lending.

Speaking at the launch over the weekend, Masawud Mohammed said CELF aligns with President John Dramani Mahama’s vision of empowering citizens through enterprise development and livelihood opportunities, particularly under the broader 24-Hour Economy agenda.

“It’s generally in line with His Excellency the President’s vision to empower the citizenry to provide livelihood and enterprise development opportunities for the people of Ghana,” he said. “Knowing the challenges confronting our society, it was important for me to help bridge the gap between those who can access formal opportunities and those who cannot.”

CELF provides interest-free, soft loans to traders and artisans, alongside basic financial literacy training aimed at improving business management and reducing loan default. According to Mr. Mohammed, the programme recognises that limited progress among small business owners is not only due to lack of capital, but also gaps in financial knowledge.

The fund operates as a revolving facility, allowing repayments from beneficiaries to be redistributed to new applicants. Repayment will be done weekly, using flexible systems supported by digital tools to make compliance easier. Credit rating mechanisms will also be introduced to assess repayment behaviour and allow qualified beneficiaries to access higher amounts over time.

“For us, it is not just about giving money,” he explained. “It is about providing knowledge and awareness so beneficiaries can make good use of the capital and sustain the initiative.”

The programme does not target specific sectors and is open to all legal trades. However, applications will be assessed based on business viability by officers underwriting the facility. The initiative is being implemented in collaboration with the Market Queen Mothers Association in the Ashanti Region.

Mr. Mohammed stressed the importance of responsible use of the funds, noting that resources are limited and the survival of the programme depends on beneficiaries honouring their repayment obligations.

Although loan amounts will vary depending on individual needs, he disclosed that about 200 beneficiaries are expected to benefit in the initial phase. With consistent repayments, the fund is expected to onboard at least 15 new beneficiaries weekly.

The launch of CELF was marked as a celebration of resilience and economic dignity, with organisers expressing confidence that the initiative will strengthen household incomes, local markets and community-based enterprise across the region.

Source: www.kumasimail.com