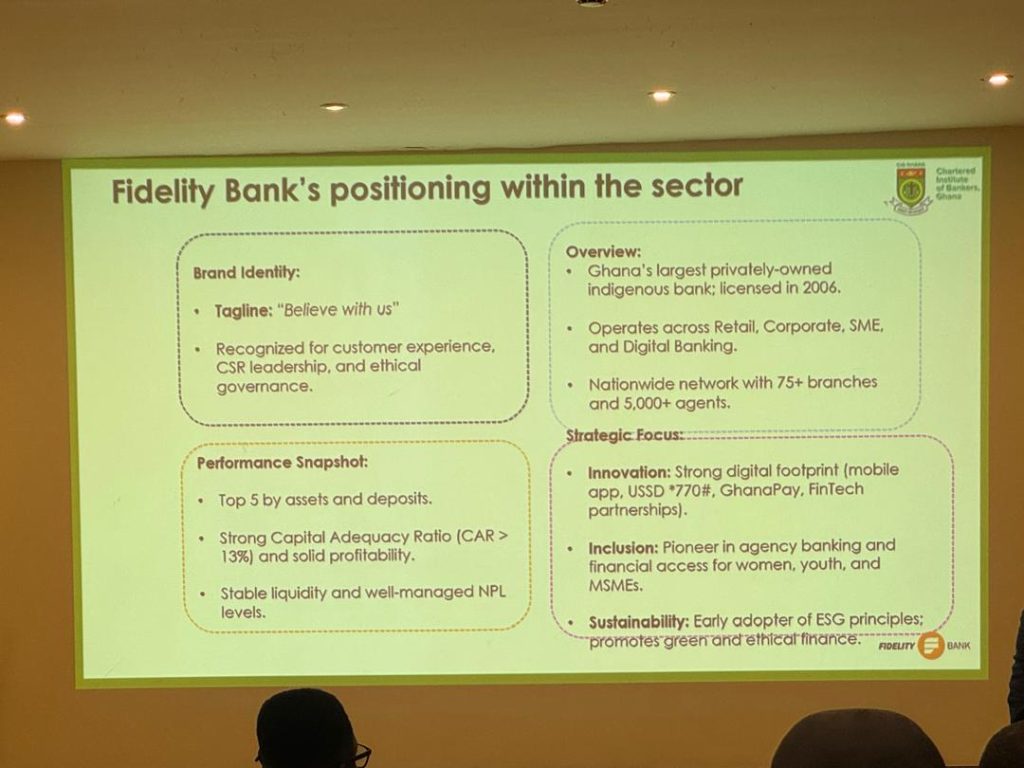

Fidelity Bank Ghana has reaffirmed its position as one of the country’s leading financial institutions, posting strong performance across key profitability, asset quality and capital adequacy indicators, according to data presented at a recent banking sector engagement.

The bank, Ghana’s largest privately owned indigenous bank, continues to rank among the top five banks by assets and deposits, supported by a nationwide footprint of more than 75 branches and over 5,000 agents, operating across retail, corporate, SME and digital banking segments.

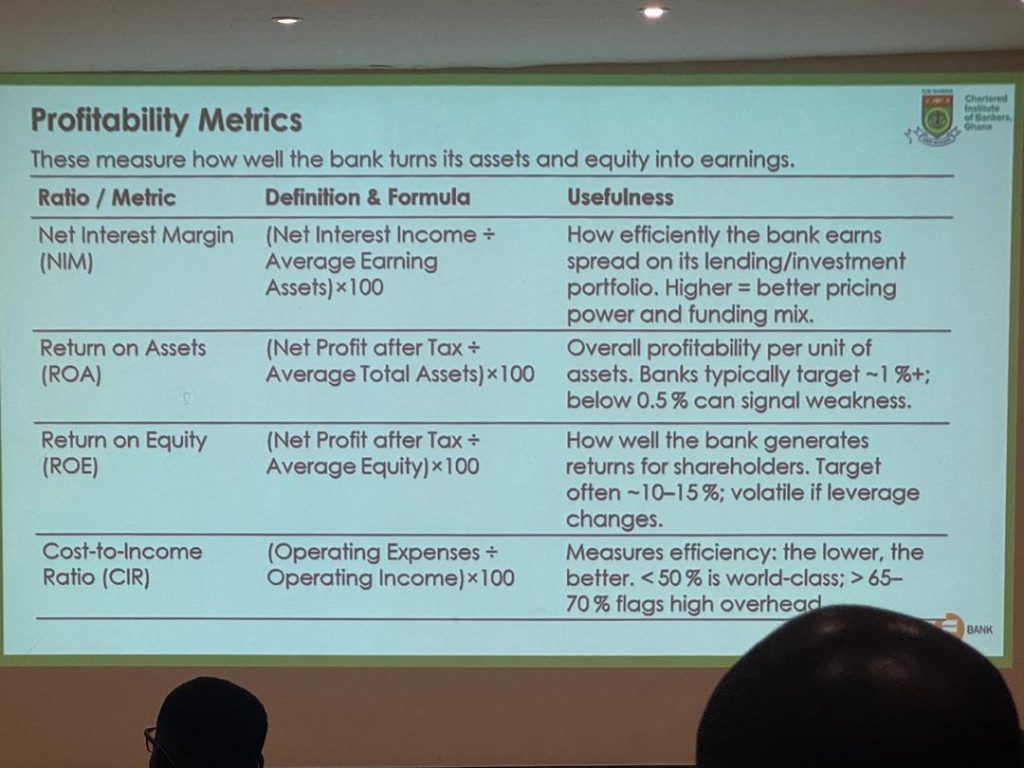

Solid Profitability

Figures presented show that Fidelity Bank remains profitable, with healthy Net Interest Margin (NIM), reflecting efficient pricing of loans and investments. The bank’s Return on Assets (ROA) and Return on Equity (ROE) also indicate steady earnings generation from its asset base and shareholder funds, aligning with industry benchmarks for strong-performing banks.

Operational efficiency remains a key focus, with the bank managing its cost-to-income ratio to balance growth and overheads, an indicator analysts say is critical in a high-interest and competitive operating environment.

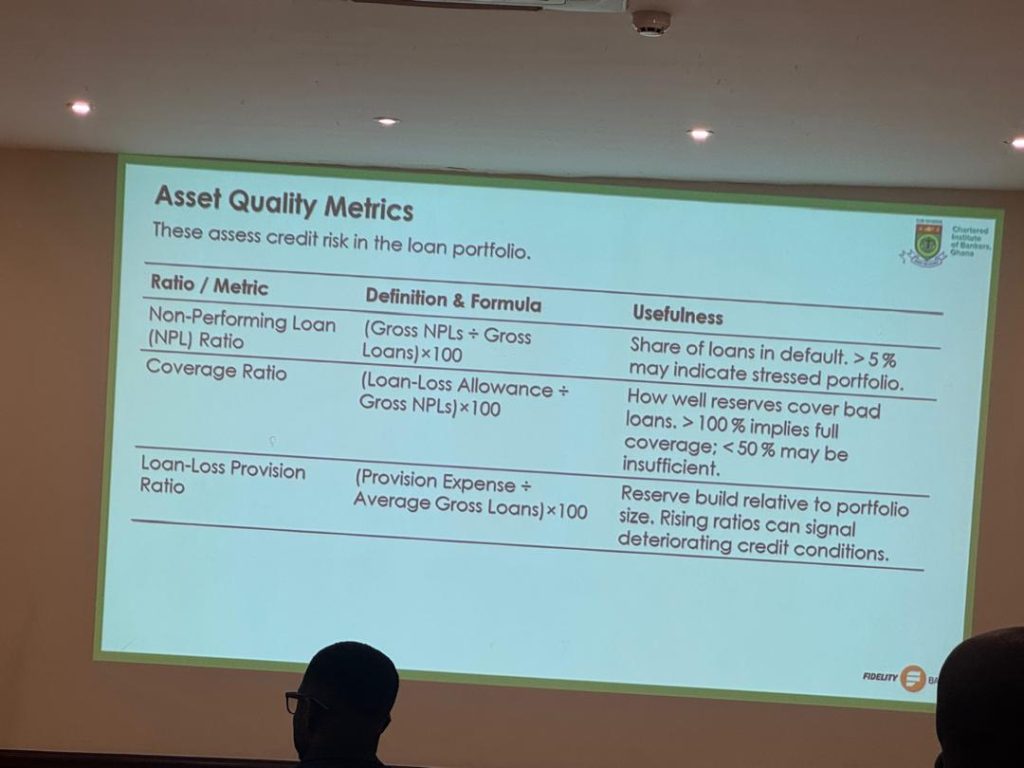

Stable Asset Quality

On asset quality, Fidelity Bank reported well-managed non-performing loan (NPL) levels, supported by adequate loan-loss provisions. The bank’s coverage ratio suggests that reserves are sufficient to absorb potential credit losses, while provisioning trends point to proactive risk management in a challenging macroeconomic climate.

Industry observers note that maintaining asset quality remains crucial as banks navigate pressures from inflation, exchange rate volatility and tightening credit conditions.

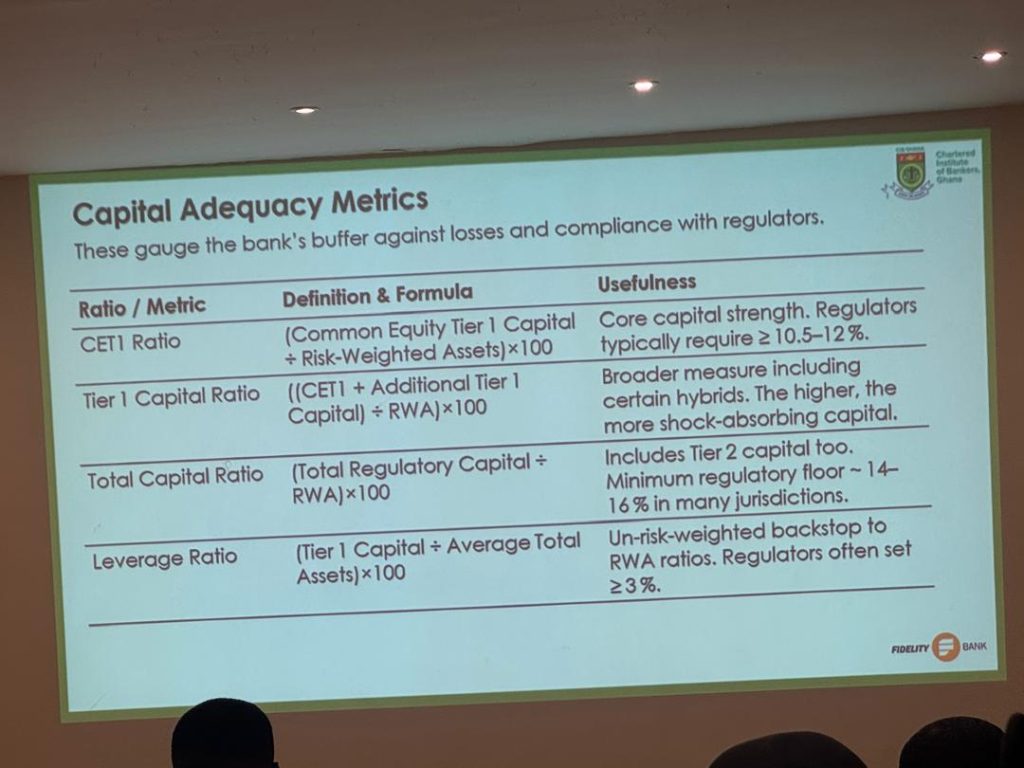

Strong Capital Buffers

The bank also continues to maintain a strong capital position, with capital adequacy ratios above regulatory minimums. Key indicators such as Common Equity Tier 1 (CET1), Tier 1 Capital Ratio, and Total Capital Ratio demonstrate Fidelity Bank’s capacity to absorb shocks and support future growth.

The bank’s leverage ratio further underscores its resilience, providing an additional buffer beyond risk-weighted capital requirements.

Strategic Focus

Fidelity Bank’s strategy is anchored on innovation, inclusion and sustainability. The bank has built a strong digital footprint through mobile banking, USSD (*770#), GhanaPay and fintech partnerships, while pioneering agency banking to expand financial access for women, youth and SMEs.

It has also positioned itself as an early adopter of Environmental, Social and Governance (ESG) principles, promoting ethical and green finance as part of its long-term growth agenda.

With strong fundamentals across profitability, asset quality and capital adequacy, Fidelity Bank appears well-positioned to remain competitive and resilient within Ghana’s evolving banking sector.

Source: www.kumasimail.com