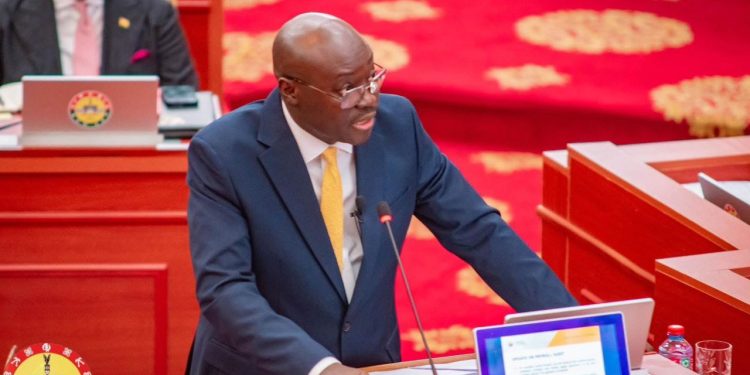

Finance Minister Dr. Cassiel Ato Forson has announced the establishment of two dedicated Sinking Fund Accounts by the government to better manage upcoming debt repayments and ease pressure on the national budget.

The accounts; a Cedi Sinking Fund and a US Dollar Sinking Fund will begin accumulation of reserves starting August 2025, according to Dr. Forson’s midyear budget review delivered on July 24 in Parliament.

This initiative is part of the government’s implementation of Sections 37 to 44 of the Public Financial Management Act, 2016 (Act 921), amended to provide a legal framework for building cash buffers that facilitate timely repayment of specified public debts.

The focus is on meeting obligations arising from Ghana’s Domestic Debt Exchange Programme (DDEP) bonds as well as Eurobond maturities due between 2026 and 2028.

The government intends the “Cedi Sinking Fund to address large domestic debt service ‘humps’ with targeted repayments of GH₵20 billion in 2026, GH₵50.3 billion in 2027, and GH₵45.75 billion in 2028.”

In parallel, the “US Dollar Sinking Fund will cater to Eurobond redemptions, with scheduled disbursements of approximately US$1.42 billion in 2026, US$1.17 billion in 2027, and US$1.14 billion in 2028.”

Dr. Forson explained that this pre-funding strategy aims to avoid the pitfalls of last-minute borrowing or sudden fiscal adjustments that disrupt public services.

He indicated “The implementation of the Sinking Fund will provide a reliable buffer that ensures timely and predictable redemption of designated public debt obligations.”

The Finance Minister emphasized that adopting this structured approach will bolster investor confidence by demonstrating Ghana’s commitment to long-term debt sustainability.

“This structured approach to debt servicing will enhance investor confidence and contribute to long-term debt sustainability,” Dr. Forson remarked.

Source: www.kumasimail/Kwadwo Owusu